Important Considerations While Reviewing Your Pension Plans Annual Statement

By now, you should have received your Pension Plans annual statement. You can also view your annual statement (and obtain other pension and health benefits information) from your portal account by logging in to www.dgaplans.org/myPHP. Your annual statement details your vested status in both the Basic and Supplemental Benefit Plans, and includes an estimate of your Basic Plan benefits upon retirement, and your Supplemental Plan account balance as of the last day of the preceding calendar year. Your annual statement can be an important tool for planning your financial future. When using your annual statement to anticipate future benefits, however, keep in mind that the benefit amounts shown on your statement may differ from the actual amounts available to you upon retirement, due to a variety of factors, including additional work in covered service, the date your benefits commence, any Qualified Domestic Relations Orders (QDROs) in effect, adjustments due to audits of employer contributions, and any legal requirements that must be satisfied. These factors may cause increases or reductions to your benefits that would not be reflected in your annual statement.

Benefit Commencement Date

For participants in the Basic Plan, the estimated benefit amounts shown on your annual statement may differ from the amounts you actually receive when you retire. That is because the estimated benefit amounts shown on your annual statement are based on your current age relative to Normal Retirement Age (usually 65) and any work reported through 2019. At the time you retire, however, your actual benefit amount will be calculated based on the date that benefits commence and any work reported through that date. Any variation between the two dates will likely result in an adjustment to your Basic Plan benefit amount that may or may not be reflected in your annual statement, depending on the following circumstances:

- If you are Ten-Year vested and plan to commence your benefit before you reach Normal Retirement Age, an estimate of the reduced benefit amount resulting from an early retirement will be shown on your annual statement.

- If you have surpassed Normal Retirement Age and have not yet taken a benefit, the increased benefit amount resulting from deferring your benefit commencement date beyond Normal Retirement Age will not be reflected on your annual statement.

- If you take a Basic Plan benefit but continue to work after your benefit commencement date, any additional benefit resulting from your additional earnings will not be reflected on your annual statement. After you take a Basic Plan benefit, subsequent annual statements will no longer show the estimated Basic Plan benefit amounts.

QDROs

A Qualified Domestic Relations Order is a type of court order that assigns a portion of the participant’s pension benefits to a spouse, former spouse, child or other dependent of the participant. Your annual statement may not reflect changes to your pension benefit due to any applicable QDRO’s.

Employer Audits

If it has been determined that unacceptable contributions have been made to the Pension Plans on a participant’s behalf, the Plans may recover any overpaid pension benefits based on such contributions.

When there is an adjustment that reduces the amount of acceptable contributions made on your behalf—for example, as a result of an employer audit —the estimated benefit shown on your annual statement will likely differ from your actual benefit.

Other Legal Requirements

Certain legal requirements may affect the estimated benefit shown on your annual statement. For example, if your benefits are subject to an IRS tax levy (a legal seizure of property to satisfy a tax debt), the Plans are required to withhold a certain amount from your benefits. Participants should look over their annual statements carefully and contact the Plans as soon as possible if there is a discrepancy.

If you have questions about your annual statement, please contact a Pension Department representative by phone at (323) 866-2200, Ext. 404, or email pension@dgaplans.org.

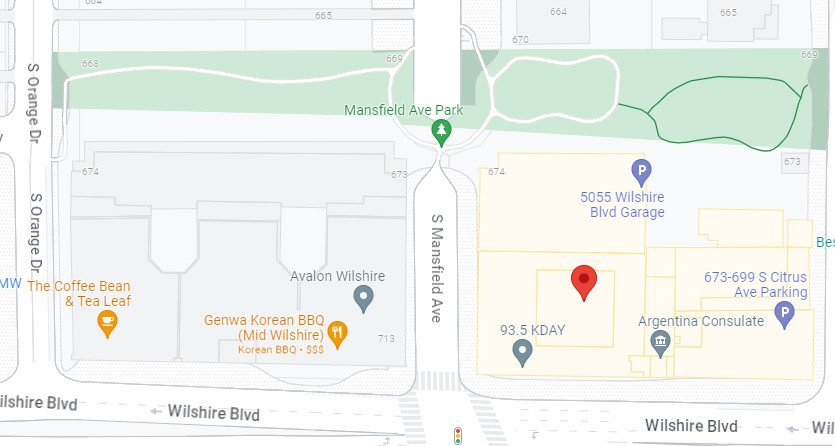

OFFICE LOCATION & HOURS:

OFFICE LOCATION & HOURS:

MEETING INFORMATION:

MEETING INFORMATION: FAXES:

FAXES: