Retiree Carry-Over Credit Eligibility Modified Effective January 1, 2025

Retiree Carry-Over Credit is a benefit for those on Medicare. Effective January 1, 2025, the number of Earned Coverage years needed for a participant to use Retiree Carry-Over credits will increase from 10 years to 20 years.

A Retiree Carry-Over Credit is earned if a participant generates at least $375,000 in covered earnings during an earnings period. One credit entitles you to self-pay for 12 months of retiree health coverage at a reduced rate.

Retiree Carry-Over Credits can only be used by participants who:

- Have at least 20 years of Earned Coverage;

- Are at least age 65; and

- Have retired from either the DGA-Producer Basic Pension and/or the Supplemental Pension Plan.

The Health Plan will grandfather current retirees who have started receiving Retiree Carry-Over Coverage until the later of January 1, 2026 or up to 12 months of Retiree Carry-Over Coverage. After this date, participants will need 20 years of Earned Coverage to use any accrued Retiree Carry-Over credits.

For more information about Retiree Carry-Over Coverage, visit www.dgaplans.org/self-paying-for-coverage.

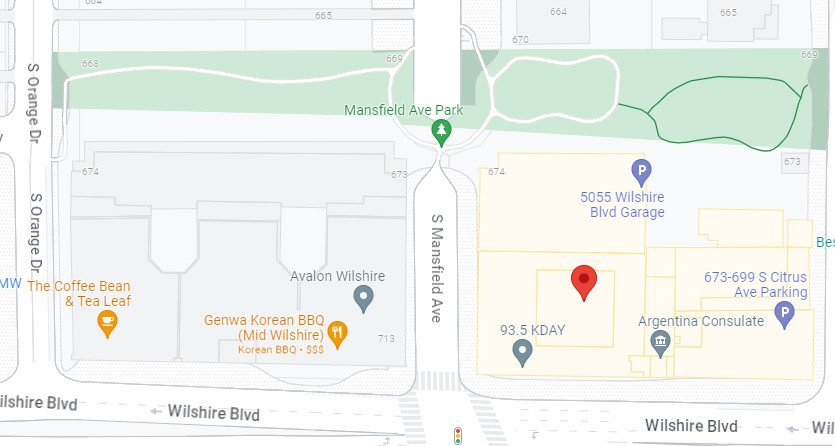

OFFICE LOCATION & HOURS:

OFFICE LOCATION & HOURS:

MEETING INFORMATION:

MEETING INFORMATION: FAXES:

FAXES: