Minimum Earnings Threshold for Health Plan Coverage Increasing to $39,820 for Earning Periods Beginning in 2025

Effective with earnings periods beginning on or after January 1, 2025, the minimum earnings required to qualify for Health Plan benefits will increase from $37,925 to $39,820 for the DGA Choice Plan and from $123,000 to $129,150 for the DGA Premier Choice Plan.

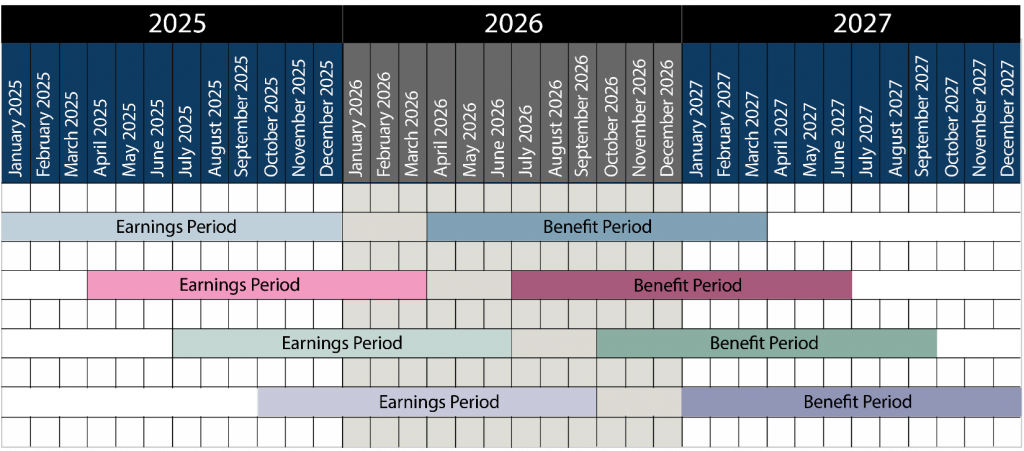

To qualify for benefits under the Choice or Premier Choice Plans, you must earn the corresponding minimum during any 12-month earnings period beginning January 1, April 1, July 1 or October 1 in 2025. (Refer to the chart below for details.) Not all earnings are reportable for Pension and Health purposes. Only allowable earnings covered under each Bargaining Agreement are counted toward the Health Plan’s earnings threshold.

These adjustments align the Health Plan’s minimum earnings threshold for coverage with the wage increases negotiated by the DGA in its Collective Bargaining Agreements.

EARNINGS AND BENEFIT PERIODS 2025-2027

The chart below details the 2025 earnings periods and their corresponding benefit periods.

OFFICE LOCATION & HOURS:

OFFICE LOCATION & HOURS:

MEETING INFORMATION:

MEETING INFORMATION: FAXES:

FAXES: